Self-Employed

Work smarter, not harder. Earn extra income by leveraging your network. You don't need any additional capital to start earning with us.

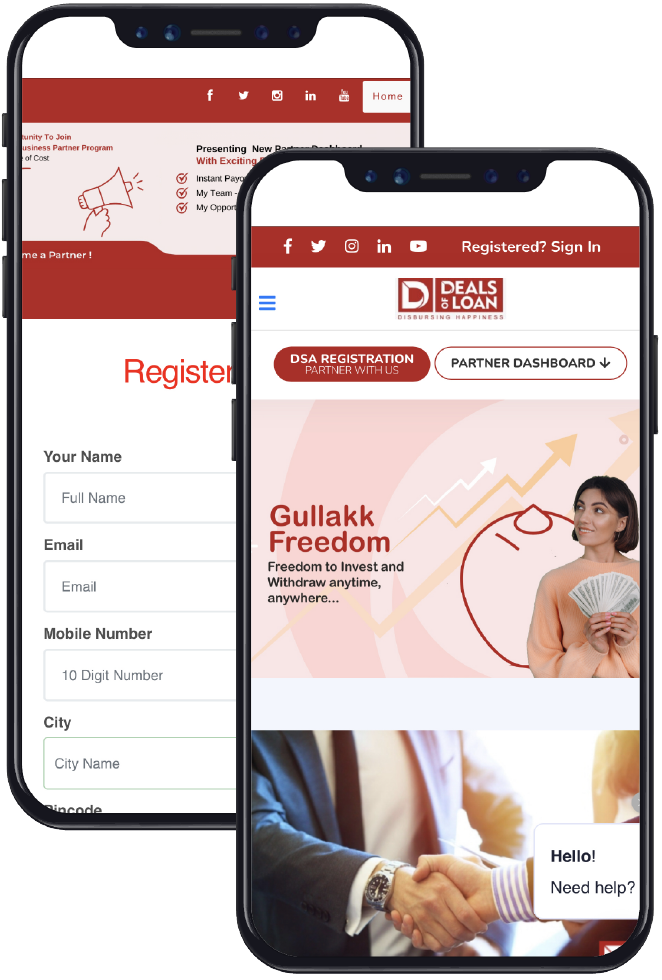

DealsoFloan has an advanced FinTech platform that is integrated with leading banks and NBFCs, We provide fulfillment services for a wide range of financial products including loans, credit cards, and bank accounts. As a partner, you get access to our platform through the partner mobile app and partner portal. We enable you to fulfill every financial need of your customer. Our partners get the best commission in the market under our Privilege Partner program.

A Fixed Investment involves a lump sum deposit at a fixed interest rate for a specified period, offering secure returns up to 11.50% p.a. with principal protection.

Read MoreGullakk offers convenient recurring investment options for long-term financial growth and security.

Read MoreIntroducing Indipe: our new merchant payment QR brand offers seamless transactions and unique instant business loan eligibility for shopkeepers.

Read MoreDOL Money’s Credizy Mobile Loan offers offers competitive rates and flexible repayments, simplifying mobile device purchases for customers.

Read MoreSeeking a digital business loan for expansion and growth; streamlined application process and quick approval is essential.

Read MoreThe sound of your growing business. The DOL Money Soundbox is a smart device with audio assistance that notifies you instantly when a payment is received.

Read MoreAn initiative by the Government of India, ONDC is a golden opportunity for DOL Partners to earn payouts on a per-order basis. Join us in embracing the future of digital commerce and unlock new avenues for earning and growth.

Read More

» Railway booking

» Digital Insurance

» Digital Bank Account

» AEPS Service

» Billing/Recharge

» Money Transfer

Work smarter, not harder. Earn extra income by leveraging your network. You don't need any additional capital to start earning with us.

Make money while helping people. If you are a LIC or insurance agent, real estate broker, network marketing person etc become our partner and start earning more.

Make use of your experience. Become our partner and earn extra income by assisting others with their financial needs.

Work for yourself. Earn extra income by working in your spare time for us.

Register on our website or partner dashboard and register.

Complete your KYC process digitally.

Checkout Training Videos, DSA Hand book for Product. Know how the digital lead processing in various Banks/ NBFCs.

Share product details with your customers using the partner mobile app or parner portal. Help your customers in completing the applications. Track application status, Get paid on disbursement, account opening or issuance of credit card as per the payout cycle digitally.

We have a fully automated payout calculation and distribution process. You can track calculations and payouts yourself using the Partner mobile app.

We provide a diverse range of 15+ financial products, including loans, credit cards, bank accounts, and trading options from top institutions.

We can process leads from pan India locations digitally. We cover over 6000+ cities and towns spanning all states and union territories of India.

Safe and secure digital process for application processing. DOL Partner app helps you carry out all your tasks on the go from anywhere.

Our dedicated sales and training team is committed to supporting you on every step to achieve your goals.

DOL partner app enables perpetual customer earnings through tailored product offerings shared via product details and application links.

Dealsofloan introduces QR code digital loans, plus personal and business loans, savings accounts, and more.

We're dedicated to ensuring your satisfaction. To simplify your interaction with our products and services, we've curated a comprehensive list of FAQs here.

Experiences

Happy Client

There is no limit for becoming DealsofLoan DSA Partner. Anyone of Indians between 18+ to 65 years of age can register as a partner with us.

We need minimal documentation from your side to become partner that includes Aadhar Card, PAN Card, Cancelled Cheque, A Photograph, Address Proof

On Lead conversion i.e once Loan Application Disbursed from Bank/ NBFCs you will get Paid as per the payout cycle digitally.

Currently Dealsofloan is offering more than 15+ financial products like Personal Loan, Business Loan, Home Loans, Mortgage Loan, Credit Cards, etc.

Yes, We take minimal Partner DSA subscription charges. We do not charge anything in cash or hidden charges for loan application or approval.

As we all knows to give money is always easier than to ask someone to invest money, so loan franchise business is huge profitable business, if we start as a single we can get margins up to 90% of payout collection, and with the team size it can be up to 50% - 60% margin from the total payout collection after all expenses.